Is Your Gold Jewelry a Smart Investment? Decoding the Premium

Why Investment Quality Jewelry Matters More Than Ever

Investment quality jewelry is more than beautiful adornment—it's a tangible asset that can appreciate in value while providing personal enjoyment. Unlike stocks or bonds, jewelry offers the unique benefit of being worn and treasured while potentially growing your wealth.

Key factors that define investment quality jewelry:

- Premium materials: High-karat gold (18k-24k), platinum, and genuine precious gemstones

- Superior craftsmanship: Expert workmanship that ensures durability and timeless appeal

- Rarity and provenance: Limited availability, historical significance, or designer heritage

- Market performance: Pieces that retain or exceed their original value over time

- Certification: Proper documentation from recognized gemological institutes

The jewelry market has grown by 6% in value over the past year, with gold reaching record highs of $2,685.49 per ounce as of September 2024. Some luxury pieces hold an impressive percentage of their original value, with certain items retaining over 100% of their original value in the resale market.

But here's what many don't realize: not all jewelry qualifies as an investment. Mass-produced pieces or those made with inferior materials often depreciate rapidly, while authentic, well-crafted pieces can become family heirlooms that appreciate over generations.

I'm Eric Roach Zalori, a serial venture capitalist who has built and sold multiple companies to entities like Morgan Stanley, and now focus on providing authentic precious metals and investment quality jewelry through Summit Metals Holdings and Zalori. My experience has taught me that true value lies in materials and craftsmanship that stand the test of time.

The Foundation of Value: Precious Metals and Gemstones

The core of investment quality jewelry is its materials. Without premium metals and genuine, high-quality gemstones, a piece is merely an accessory, not a potential asset.

The Role of Precious Metals

Precious metals are fundamental to a jewelry piece's worth. Their market prices fluctuate, but they play a huge role in determining value, especially when a significant amount of metal is used.

Take gold, for example. For thousands of years, it's been a global symbol of wealth and a safe-haven asset. Its price has steadily climbed over the last five years, hitting a record high of $2,685.49 per ounce in September 2024. This consistent performance makes high-karat gold jewelry a smart choice. So, when people ask if investing in gold jewelry makes sense, our answer is a resounding "yes." Gold, along with platinum, is truly the best metal for a jewelry investment, especially when paired with beautiful gemstones.

While no one can predict the future perfectly, gold's global demand and its long-standing role as a "crisis currency" suggest its value is likely to keep rising.

Platinum is another fantastic investment. It's extremely rare, incredibly durable, and resists tarnish. Its value tends to be very stable, making it another "crisis-proof" option. While industrial uses can affect its price, its natural qualities make it highly sought after for investment quality jewelry.

Even silver, which is more affordable, adds to a piece's value. Sterling silver (92.5% pure silver) is a popular choice for its durability and beauty. While its investment potential might not match gold or platinum on its own, its presence in a well-made piece boosts its overall charm and intrinsic worth.

When choosing gold for investment, it's crucial to understand karats, which indicate purity:

| Karat | Gold Content | Durability | Purity | Investment Potential |

|---|---|---|---|---|

| 14k | 58.5% | Very Good | Moderate | Good (balance of durability & value) |

| 18k | 75% | Good | High | Very Good (high purity, still durable) |

| 24k | 99.9% | Soft | Pure | Excellent (highest intrinsic value) |

Want to dive even deeper into gold purity? Check out our helpful guide on Solid Gold Jewelry: 14k vs 18k vs 24k.

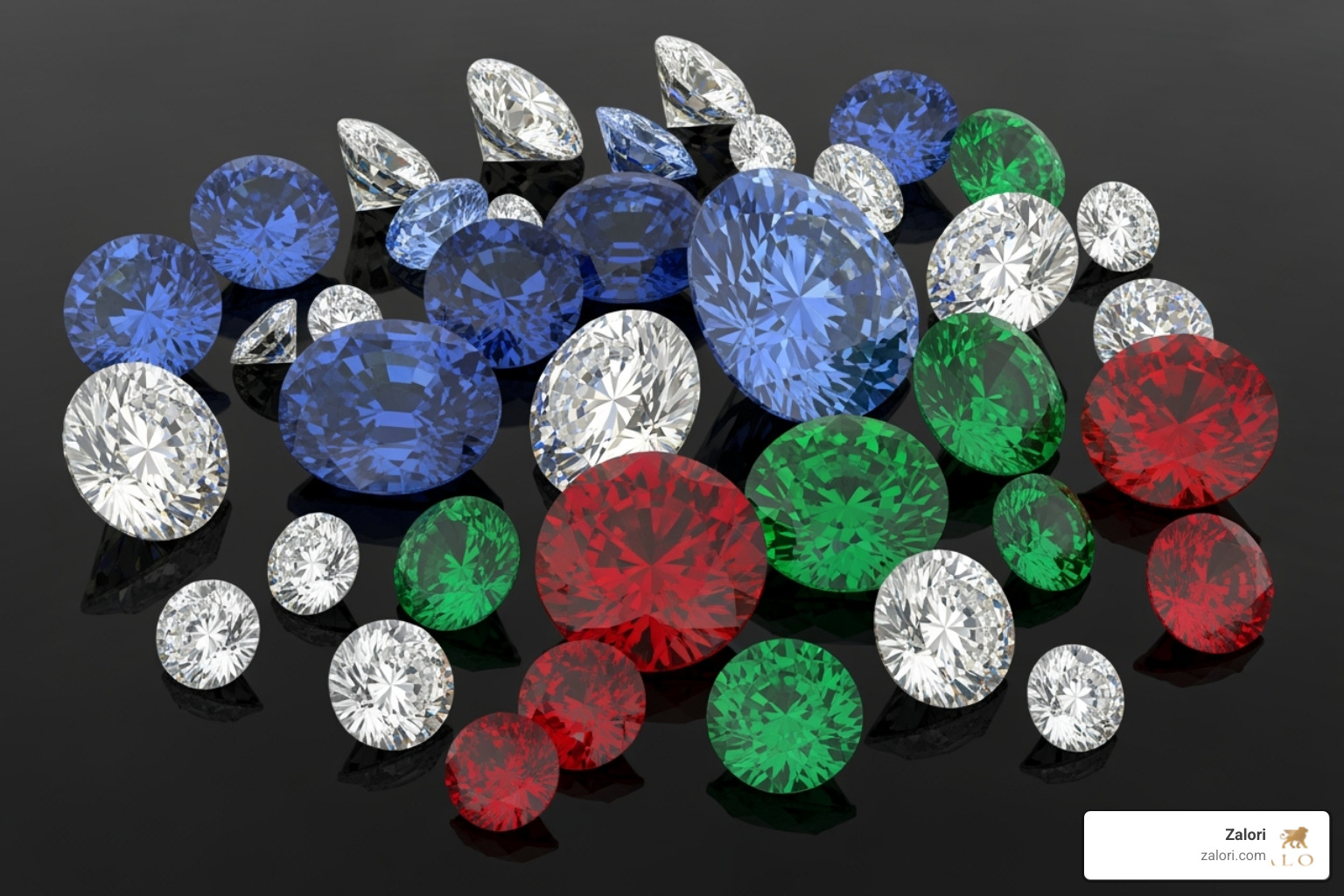

The Significance of Gemstones

Beyond the shining metals, gemstones add serious value to investment quality jewelry. Diamonds are the classic choice, with their investment potential often judged by the famous "4 Cs":

- Cut: How well the diamond's facets interact with light.

- Color: For white diamonds, the absence of color. For fancy colored diamonds, the richness of their hue.

- Clarity: The absence of internal or external flaws.

- Carat Weight: The diamond's weight.

For an authoritative primer, see the GIA 4Cs guide.

While traditional white diamonds have shown modest returns, natural colored diamonds are where the real excitement is. Incredibly rare gems, like Argyle Pink Diamonds (from a mine that closed in 2020), have much higher return potential, though they come with a significantly higher price tag. The Oppenheimer Blue diamond, which sold for an astounding $57,541,779 in 2016, is a testament to the immense value of rare, exceptional gemstones.

Colored gemstones like sapphires, rubies, and emeralds are also gaining recognition as fantastic investments. New gemstone findies have declined for years while global demand keeps growing. This mix of scarcity and desire has led to fine colored gemstones appreciating by double-digit percentages annually in certain sizes over the past decade. Super rare varieties, like Padparadscha sapphires, alexandrite, Paraiba tourmalines, and cobalt spinels, are especially great for investment because they're uniquely beautiful and incredibly hard to find.

So, are gemstones a good investment? Yes. When fine and rare, gemstones have proven to be stable and have shown impressive returns. Having these precious colored gemstones in a piece of jewelry makes a huge difference to its overall value.

Finally, we can't stress enough the importance of certification. A certificate from a trusted, independent lab (like GIA or GRS) gives you solid proof of a gemstone's authenticity and quality. This paperwork is vital for showing a piece's investment worth and is a must-have for resale. To truly understand how to protect your investment, we highly recommend reading our guide: Open up the Truth: Why Certified Gemstone Jewelry is Your Best Bet.

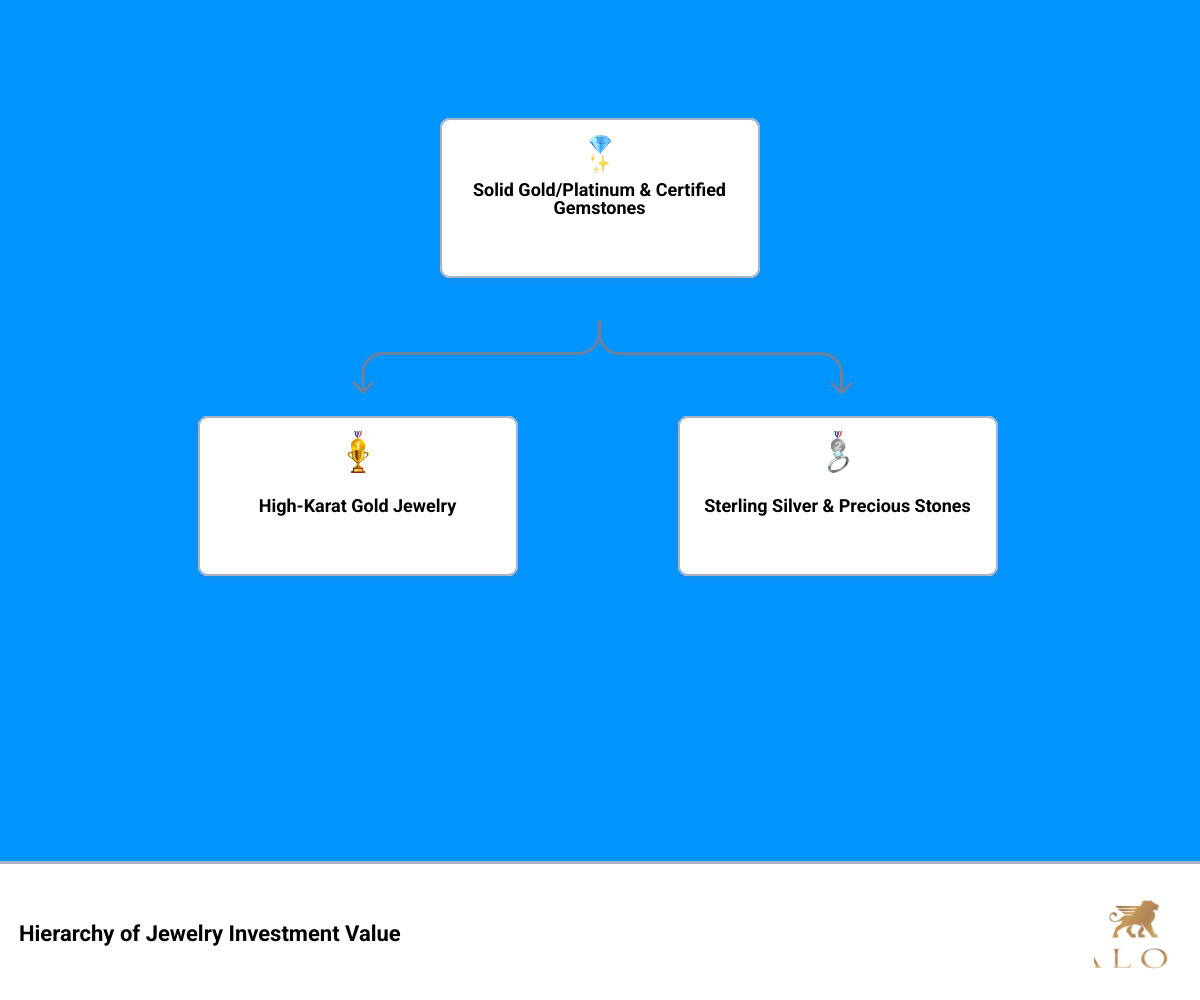

What Defines Investment Quality Jewelry?

Beyond the raw materials, several key factors lift a piece of jewelry from a simple accessory to a true investment. These are the subtle but powerful nuances that transform a beautiful trinket into a valuable asset that can grow with you.

The Hallmarks of Investment Quality Jewelry

Let's start with superior craftsmanship. This isn't just about something looking pretty; it's about the incredible skill and artistry that goes into making a piece. We're talking meticulous attention to every tiny detail, stones set with perfect precision, and construction that feels incredibly solid. This level of quality doesn't just make a piece more beautiful; it also ensures it’s durable enough to last for generations, truly standing the test of time. As we always say, it’s about being Crafted to Perfection: Understanding What Makes a Product Truly High Quality.

Then there's the magic of rarity and unique design. Think about pieces that are limited edition, custom-made, or just so distinctive they couldn't possibly be copied. These unique qualities make them highly collectible and often lead to impressive long-term appreciation. It’s about owning something truly special that few others have.

And who can forget the power of brand heritage? When it comes to investment quality jewelry, some names carry significant weight. Iconic design houses don't just sell jewelry; they sell prestige and a proven history of holding—or even increasing—their value. For instance, certain luxury timepieces can average over 100% of their original value on the secondary market. Famous bracelet designs from top jewelers often retain a very high percentage of their value. Beloved necklace collections known for their timeless elegance can also hold an impressive portion of their value, sometimes exceeding the original retail price. Even unique, symbolic pieces from both established and newer designers can command high resale values if they capture the market's imagination.

However, not all luxury brands are created equal when it comes to investment potential. Some tend to hold significantly less value in the secondary market, often retaining less than 50% of their resale value. This highlights that a "luxury" label doesn't automatically make a piece investment quality jewelry.

Last but certainly not least, provenance and historical significance truly lift a piece. Imagine owning a piece of jewelry with a documented history, perhaps one that belonged to a famous personality or was part of a significant historical event. This kind of verifiable proof of origin, quality, and story can dramatically increase its value. It's not just jewelry; it's a piece of history you can wear!

Vintage and Heirloom Pieces: A Class of Their Own

Investing in vintage or antique jewelry is a delightful journey with unique rewards. These pieces are naturally rare, often one-of-a-kind, and they beautifully capture the craftsmanship and design spirit of a bygone era. Plus, choosing vintage is a wonderful, sustainable choice, as it repurposes existing materials and reduces the demand for new mining—a conscious approach to luxury we can all appreciate.

The true beauty of vintage jewelry lies in its unique historical craftsmanship. Many of these pieces were handcrafted using techniques and materials that are simply not available today, making them genuinely irreplaceable. This inherent scarcity, combined with their timeless appeal, helps them appreciate wonderfully over time. As experts note, antique and estate jewelry has historically proven resilient to market ups and downs; in fact, its value often grows when other currencies might falter.

Heirloom-quality jewelry, lovingly passed down through generations, carries not only financial value but also immense emotional significance. It’s more than an object; it tells a story, connects us to our past, and can even be reimagined to honor those cherished connections. This beautiful blend of financial appreciation and deep sentimental value makes vintage and heirloom pieces a truly unique and meaningful investment.

The Market for Wearable Assets

Understanding how investment quality jewelry performs compared to other luxury assets gives you the confidence to make smart decisions. It's not just about what catches your eye – it's about what holds its value in the real world.

Jewelry vs. Other Tangible Luxury Assets

When you compare jewelry to other luxury investments like real estate or art, some fascinating advantages emerge. Think about portability – your grandmother's diamond bracelet can travel with you anywhere, while that beautiful painting stays put on your wall. This makes jewelry a truly portable store of value that moves with your life.

The numbers tell an encouraging story too. The jewelry market has grown by 6% in value over the past year, according to industry reports. Luxury timepieces performed even better, with 18% growth in 2022. These aren't just statistics – they represent real appreciation in pieces people actually wear and enjoy.

But here's what makes jewelry special: you get to experience the emotional return of wearable art every single day. Unlike stocks hidden in your portfolio or real estate you can't touch, your jewelry investment improves your life while potentially growing your wealth. You wear it to celebrate anniversaries, pass it down to children, and create memories that last lifetimes.

The liquidity factor also sets jewelry apart. While selling a house takes months and involves hefty transaction costs, quality jewelry can be more readily converted to cash when needed. Plus, there's something deeply satisfying about an investment that brings daily joy rather than just sitting in a vault.

Understanding Resale Value and Appreciation

The reality is that not all jewelry holds its value equally. Iconic designs from prestigious brands consistently outperform, often because they've proven their staying power over decades. When a design becomes truly timeless, it transcends fashion trends and maintains strong market demand.

Superior craftsmanship and quality materials form the backbone of value retention. Pieces made with high-karat gold, platinum, and certified natural gemstones have intrinsic worth that provides a foundation for appreciation. The skill involved in creating these pieces – the precision stone setting, the attention to detail – ensures they remain desirable for generations.

Some pieces retain over 100% of their original value, which is remarkable in any investment category. This happens when you combine exceptional materials, masterful craftsmanship, and designs that capture hearts across generations.

On the flip side, mass-produced or plated items typically depreciate rapidly. They lack the intrinsic material value and superior construction that characterize true investment quality jewelry. This is why understanding materials matters so much – you can explore the differences in our guide: The Material World: Uncovering the Secrets of True Quality.

Rarity and provenance also play crucial roles in appreciation. Pieces with documented histories, unique designs, or connections to significant moments command premium prices. The story behind a piece often becomes as valuable as the materials themselves.

The jewelry market's 6% growth reflects a broader appreciation for tangible luxury assets. In uncertain times, people gravitate toward investments they can see, touch, and enjoy – making jewelry an increasingly attractive option for diversifying wealth while maintaining lifestyle enjoyment.

How to Invest Wisely in Jewelry

Building a collection of investment quality jewelry requires a blend of passion and prudence. Think of it as choosing pieces that speak to your heart while making sense to your wallet. The key is making informed choices that satisfy both your aesthetic desires and your financial goals.

A Buyer's Checklist for Sound Investments

When you're ready to invest in a significant piece, there are several crucial steps that separate smart buyers from impulsive ones. The most important rule? Always seek expert appraisal from qualified and reputable gemologists. This provides an objective assessment of the materials, craftsmanship, condition, and market value. Making an informed decision is always better than going in blind.

Documentation and certificates are absolutely non-negotiable for investment quality jewelry. Certificates from independent gemological laboratories like GIA for diamonds or GRS for colored stones provide crucial proof of authenticity, quality, and origin. Think of these certificates as your jewelry's passport - without them, proving value becomes much harder down the road.

Take time to research design history and brand reputation. Iconic pieces with a rich heritage often hold their value better than trendy designs that might feel dated in a few years. While famous brands can add collector's value, don't overlook individually created jewelry from trusted goldsmiths and designers. These pieces can offer excellent value for money without the brand premium.

Understanding gemstone grading reports empowers you to make smarter decisions. Familiarize yourself with the 4 Cs for diamonds or the specific quality factors for colored stones. When you know what those numbers and grades actually mean, you're less likely to overpay or miss a great opportunity.

Quality should always trump quantity in your collection. Focus on pieces made with high-quality precious metals - at least 14-karat gold or platinum - and fine, rare gemstones. Only high-quality jewelry maintains stable value over time.

Consider ethical sourcing as both a values decision and a smart investment choice. Jewelry made with Fairmined gold or traceable gemstones from artisanal miners tells a better story and appeals to increasingly conscious buyers. Learn more in A Guide to Ethical Sourcing: How to Choose Jewelry That Aligns With Your Values.

Precious metals and gemstones do fluctuate in price, though they're generally stable over the long term. Factor these natural market movements into your investment strategy rather than expecting perfectly linear growth.

Don't hesitate to get a second opinion before making significant purchases. A reputable seller will welcome questions about the jewelry's origin, creator, gemstone quality, treatments, and provenance. If someone seems evasive about these details, that's your cue to walk away.

Finally, buy from specialized stores with proven expertise and strong track records. This ensures you're getting authentic pieces and knowledgeable guidance throughout your investment journey.

Building Your Collection of Investment Quality Jewelry

When building your collection, adopt a long-term perspective. Jewelry isn't a quick flip; its value appreciation typically unfolds over years, not months. The beautiful part is that you get to wear and enjoy your investment while it potentially grows in value.

Start with foundational pieces that form the backbone of any serious collection. A classic gold chain serves as both a versatile accessory and a direct investment in gold. Solitaire diamond studs offer timeless elegance with inherent diamond value that never goes out of style. A timeless band - whether a simple gold or platinum ring or an neat eternity band - provides everyday luxury you can wear constantly.

Consider adding a luxury timepiece from a reputable brand known for strong resale values. These pieces often appreciate significantly over time while serving as both functional tools and status symbols. A piece featuring a rare colored gemstone - perhaps a sapphire, ruby, or emerald set in a classic design - adds both beauty and investment potential to your collection.

The real joy lies in wearing your assets. Unlike stocks hidden in portfolios or real estate you can't touch, investment quality jewelry provides daily pleasure while potentially growing in value. Each time you put on that diamond necklace or admire that vintage ring, you're enjoying a beautiful asset that's working for your financial future.

We invite you to Explore our timeless collections to start building your legacy. The best investment jewelry combines exceptional materials, superior craftsmanship, and designs that speak to your personal style. When you love what you own, you're more likely to care for it properly - and that care helps preserve its investment value for years to come.

Frequently Asked Questions about Investment Jewelry

What types of jewelry are best for investment?

So, you're wondering what kind of jewelry truly counts as an investment? It's a great question, because not every sparkly piece will appreciate in value. For jewelry to be a smart investment, look for pieces made with high-karat gold or platinum. These precious metals hold their value exceptionally well.

Next, pay close attention to the gemstones. We're talking about jewelry with rare, high-quality natural gemstones. Think vibrant emeralds, deep blue sapphires, or stunning diamonds, especially those with excellent clarity and cut.

Don't forget the charm of history! Well-preserved vintage or heirloom items can be fantastic investments, especially if they have a unique story or clear origin. And, of course, the way a piece is made matters immensely. Look for jewelry with exceptional, timeless craftsmanship. This means it's built to last and designed to remain beautiful for generations.

Finally, consider individually created jewelry with gemstones of the highest quality, or exclusive unique pieces from special brands. These often have a unique artistic value that can also grow over time.

How do I know if my jewelry is a good investment?

How can you tell if that beautiful necklace or ring is truly a good investment? It comes down to a few key things. First, a piece is a good investment when it combines a high intrinsic material value (like pure gold or rare gems) with other important factors. These include its rarity, the superior craftsmanship involved in making it, and whether there's strong demand for it in the secondary market.

The very best way to know for sure is to get a professional appraisal. An expert can give you an accurate market value based on all these details. Also, always look for pieces that are well-documented and come from reputable sources. This helps prove their authenticity and quality. Essentially, if a piece aligns with the criteria we've talked about for investment quality jewelry, you're likely on the right track.

Is it better to invest in gold bullion or gold jewelry?

This is a common question, and the answer truly depends on what you hope to achieve! If your main goal is simply to invest directly in the price of gold, then gold bullion (like coins or bars) is often the most straightforward choice. It offers a very direct way to buy gold with fewer added costs beyond the metal itself.

However, gold jewelry is a bit different. Think of it as a hybrid asset. Yes, it contains valuable gold, but it also includes the value of its artistry, unique design, and the fact that you can actually wear it! This means jewelry typically has a higher price than just the raw gold it contains.

So, while bullion might give you a more direct financial return linked to gold prices, jewelry offers the wonderful benefit of being a wearable asset. You can enjoy its beauty every day, celebrate special moments with it, and even pass it down through your family as a cherished heirloom. For many, this blend of financial value and personal enjoyment makes jewelry a truly unique investment. In fact, for a well-rounded and diversified approach, many people find that a mix of both bullion and high-quality jewelry can be ideal.

Conclusion

As we've journeyed through the fascinating world of fine jewelry, it's become clear that investment quality jewelry is so much more than just a beautiful accessory. It truly is a dual-value asset, offering both the sheer joy of aesthetic pleasure and the exciting potential for financial growth. The secret sauce lies in a careful blend of top-notch quality, undeniable authenticity, timeless design, and a keen eye on how the market moves.

Think of investing in fine jewelry as investing in a wearable legacy. It's a tangible asset that you can not only enjoy today but also pass down through generations. Each piece can carry its own unique stories and hold a value that goes far beyond just its monetary worth.

Here at Zalori, we pour our hearts into every piece. We're committed to uncompromising standards, ensuring exceptional craftsmanship and carefully selecting only the highest-quality, most authentic materials. This dedication means our pieces aren't just designed to be worn; they're crafted to endure, becoming cherished heirlooms that stand the test of time.

If you're curious to dive deeper into what truly makes a piece last, we warmly invite you to Find the difference quality materials make in our comprehensive guide. It's all about making informed choices for lasting beauty and value!