Your Guide to Jewelry Sales Tax in New York City and State

Why Understanding New York Sales Tax on Jewelry Matters

New york sales tax jewelry purchases are subject to some of the highest combined tax rates in the United States. Whether you're buying a diamond engagement ring in Manhattan or ordering a custom gold necklace online, knowing these tax rules can save you from unexpected costs and compliance issues.

Here's what you need to know about New York jewelry sales tax:

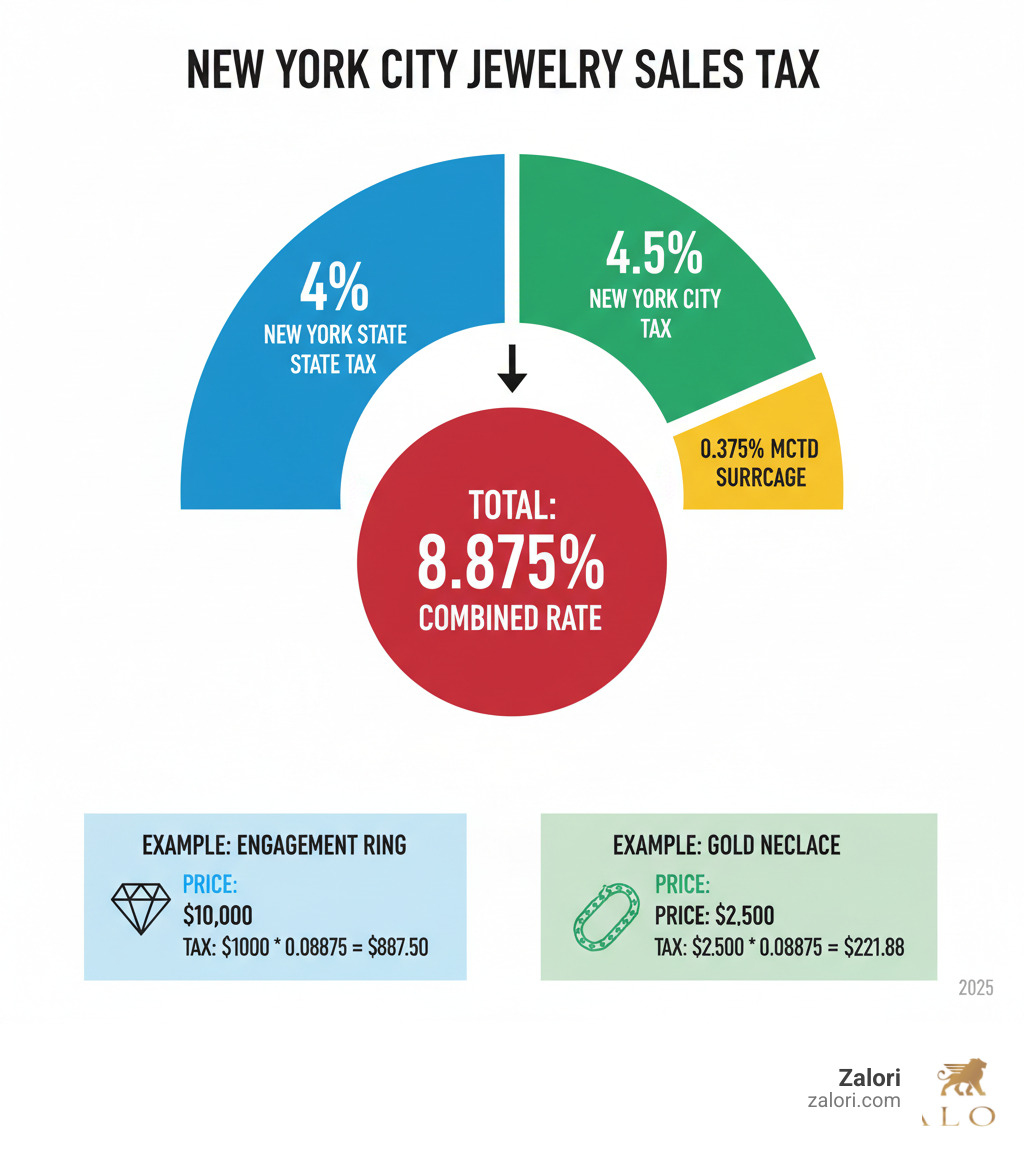

- NYC Rate: 8.875% total (4% state + 4.5% city + 0.375% MCTD surcharge)

- New York State: 4% base rate plus local taxes (varies by county)

- No Exemptions: Unlike clothing under $110, jewelry is always taxable regardless of price

- Online Purchases: Tax applies if the seller has nexus in New York

- Precious Metals: Investment bullion over $1,000 may be exempt, but fabricated jewelry is not

The complexity comes from New York's layered tax structure. While the state charges a base 4% sales tax, New York City adds its own 4.5% local tax plus a 0.375% Metropolitan Commuter Transportation District surcharge. This means luxury jewelry purchases in NYC face the full 8.875% combined rate.

Understanding these rules becomes crucial when making significant jewelry investments. A $10,000 watch purchase in Manhattan will cost you an additional $887.50 in sales tax - money that could otherwise go toward upgrading to a higher quality piece.

I'm Eric Roach Zalori, and through my experience building companies acquired by firms like Morgan Stanley and now running Summit Metals Holdings, I've steerd the complexities of new york sales tax jewelry regulations firsthand. This guide will help us understand exactly what we'll pay and when, so we can make informed decisions about our luxury jewelry investments.

Understanding the Base Sales Tax on Jewelry in New York

Shopping for jewelry in New York means navigating a layered tax system that can feel a bit overwhelming at first. Think of it like building a cake - you start with the base layer and add more on top, depending on where you're shopping.

The foundation is New York State's 4% sales tax. This applies everywhere in the state, from the busy streets of Manhattan to the quiet corners of upstate counties. But here's where it gets interesting - almost every city and county adds their own slice to this tax cake.

When you're shopping for that perfect piece of jewelry in New York City, you'll face the combined rate of 8.875%. This hefty rate comes from three different sources: the state's 4% base rate, New York City's own 4.5% local tax, and an additional 0.375% Metropolitan Commuter Transportation District (MCTD) surcharge that helps fund public transportation.

All jewelry falls under "tangible personal property," which means it's fully taxable in New York. Unlike some other states that might give luxury goods special treatment, New York keeps things straightforward - if it's jewelry, it's taxable. Whether you're eyeing a delicate silver bracelet or a stunning diamond necklace, the full sales tax rate applies to your entire purchase.

This is particularly important to understand when you're making a significant investment in quality pieces. At Zalori, we believe in transparency about all costs, including taxes, so you can make informed decisions about your luxury jewelry purchases. For more insights on making smart jewelry investments online, check out The Ultimate Guide to Buying Fine Gold and Luxury Jewelry Online.

For the most current and detailed information about New York State sales tax regulations, we always recommend consulting the official New York State Department of Taxation and Finance website.

The Difference Between NYC and Other NY Locations

New york sales tax jewelry rates vary dramatically depending on where you make your purchase. It's like a geographic lottery - move a few miles in any direction, and your tax bill could change significantly.

New York City represents the peak of the tax mountain at 8.875%. This rate applies across all five boroughs - whether you're shopping in Manhattan's Diamond District, browsing boutiques in Brooklyn, or visiting stores in Queens, the Bronx, or Staten Island. The city's 4.5% local tax combined with that MCTD surcharge really adds up.

Step outside the city limits, and things start to look different. In Westchester County locations like Purchase, you'll pay 8.375% - still substantial, but about half a percentage point less than NYC. Head further upstate to places like Diamond in Jefferson County, and the combined rate drops to 8.0% with just the state's 4% plus a 4% county tax.

New York uses a "destination-based" tax system, which means the tax rate depends on where the transaction actually takes place. For in-store purchases, that's simple - it's the store's location. For online purchases, it typically depends on where the item gets shipped, assuming the retailer has a significant business presence (called "nexus") in New York.

This geographic variation can be significant when you're making larger jewelry purchases. The difference between NYC's rate and some upstate locations could save you nearly a full percentage point in taxes.

How to Calculate the Tax on Your Jewelry Purchase

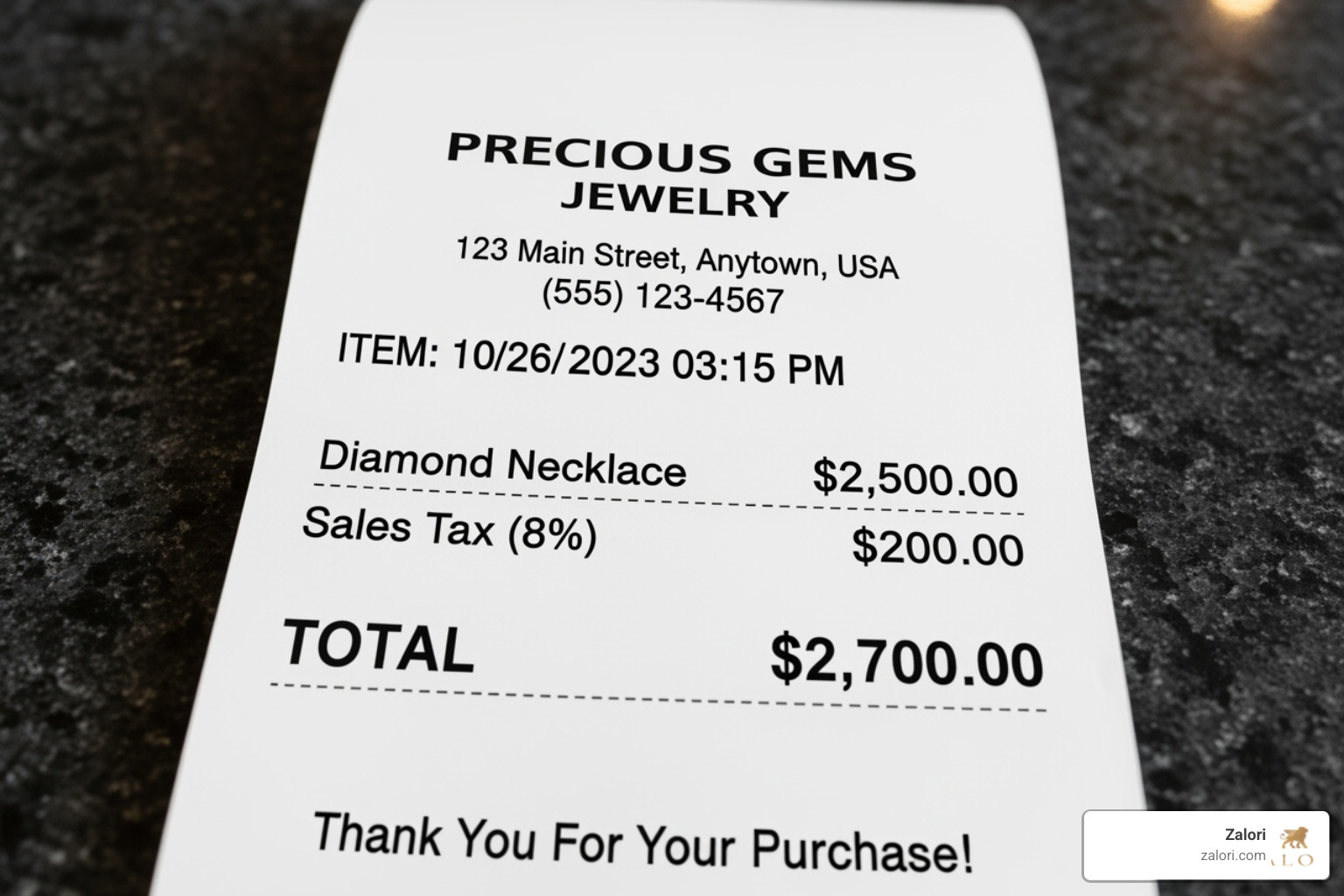

Calculating your jewelry sales tax is refreshingly straightforward once you know your location's combined rate. Simply multiply your item's price by the tax rate, then add that to your purchase price.

Let's walk through a real example using a beautiful $1,500 necklace from our collection:

In New York City: Your $1,500 necklace would incur $133.13 in sales tax (1,500 × 0.08875), bringing your total to $1,633.13.

In Purchase, NY: The same piece would cost $125.63 in tax (1,500 × 0.08375), for a total of $1,625.63.

In Diamond, NY: You'd pay $120.00 in tax (1,500 × 0.080), making your total $1,620.00.

The location difference adds up to over $13 in tax savings between NYC and some upstate areas - not huge, but certainly noticeable on larger purchases.

When you're budgeting for your next jewelry investment, always factor in the full tax amount for your specific location. This way, you won't face any surprises at checkout, and you can focus on what really matters - finding the perfect piece that reflects your style and values.

Key Exemptions and Special Cases for New York Sales Tax Jewelry

If you're hoping to find a loophole that exempts your beautiful new jewelry from New York sales tax, I have some disappointing news. When it comes to new york sales tax jewelry purchases, exemptions are about as rare as finding a perfect diamond in your backyard.

New York State takes a pretty straightforward approach to luxury items like jewelry. Whether you're buying a delicate silver ring or a show-stopping diamond necklace, the state considers all jewelry as taxable tangible personal property. This means accessories like watches, handbags, and jewelry are subject to the full sales tax rate, regardless of their price tag.

The reality is that your stunning Zalori pieces - crafted with our uncompromising standards and authentic materials - will always include sales tax in their final cost. There's no getting around it, and honestly, we believe in being completely transparent about this from the start.

For those who want to dive deeper into what's taxable and what's not in New York, the state provides a comprehensive resource. You can learn more about taxable property and services through their official guidelines. Understanding these rules helps you make informed decisions about your luxury jewelry investments, especially when you're choosing pieces that embody true quality in The Material World: Uncovering the Secrets of True Quality.

The Clothing Exemption Myth: Why the new york sales tax jewelry rules differ

Here's where things get interesting, and where many people get confused. You've probably heard about New York's famous clothing exemption - items under $110 don't get taxed. It's a nice break when you're buying everyday clothes and shoes, but here's the catch: jewelry is completely excluded from this exemption.

Think about it this way: you could buy a $50 pair of jeans and pay no sales tax, but that $50 silver bracelet? You'll pay the full 8.875% if you're shopping in New York City. The price is completely irrelevant when it comes to jewelry tax - whether your piece costs $25 or $2,500, the sales tax applies to every penny.

This distinction isn't some bureaucratic oversight. New York State deliberately separates clothing from accessories in their tax code. The exemption covers clothing and footwear under the $110 threshold, but jewelry, watches, and handbags are specifically listed as taxable items with no price-based relief.

It's one of those tax quirks that can catch people off guard, especially if they're used to the clothing exemption. But once you understand that jewelry exclusion from the clothing rules, you can budget accordingly for your next luxury purchase.

The Precious Metal Bullion Exemption: What Jewelry Buyers Need to Know

Now here's where things get a bit more nuanced, and frankly, where some jewelry buyers get their hopes up unnecessarily. New York does have an exemption for precious metals, but it's designed for investors, not jewelry lovers.

The state exempts investment-grade bullion over $1,000 from sales tax. This means if you're buying gold coins, silver bars, or platinum ingots as pure investments, and your purchase exceeds $1,000, you won't pay sales tax. It's a nice benefit for precious metal investors.

But here's the important distinction for jewelry buyers: this exemption doesn't apply to fabricated jewelry. Once precious metals are crafted into wearable art - transformed into rings, necklaces, or earrings - they're no longer considered investment bullion. They become luxury consumer goods, and the full sales tax kicks in.

So even if you're buying a solid gold chain worth $1,500, it's still considered fabricated jewelry rather than raw investment metal. The craftsmanship and design work that transforms raw gold into a beautiful piece changes its tax classification entirely.

This distinction matters because some people assume expensive gold jewelry might qualify for the bullion exemption. Unfortunately, that's not how the tax code works. When you're investing in Zalori's expertly crafted pieces, you're getting exceptional artisanship and quality materials, but you should expect to pay the full sales tax regardless of the precious metal content.

If you're curious about the investment aspects of precious metal jewelry, our guide Is Your Gold Jewelry a Smart Investment? Decoding the Premium explores that topic in depth. Just remember that from a tax perspective, beautiful jewelry and investment bullion are treated as completely different categories.

How Tax Applies to Different Jewelry Transactions

The way sales tax works on new york sales tax jewelry isn't one-size-fits-all. Whether you're browsing online, visiting a showroom, or commissioning a custom piece, different scenarios bring different tax considerations. Let's explore how these various transaction types affect what you'll actually pay.

Online Purchases vs. In-Store Shopping for new york sales tax jewelry

Shopping for jewelry online versus in-store creates very different tax situations. The key factor that determines whether you'll pay sales tax on an online purchase comes down to something called sales tax nexus - essentially whether the retailer has a significant enough connection to New York to be required to collect tax.

When you walk into a physical jewelry store in New York, the tax situation is straightforward. That store will collect the full sales tax rate for its specific location. If you're shopping in Manhattan, you'll pay the full 8.875% combined rate. Simple as that.

Online shopping gets more complex. If an online retailer has physical presence in New York - like a store, warehouse, office, or even employees working in the state - they must collect New York sales tax on purchases shipped to New York addresses. This is traditional nexus, and it's been around for decades.

But there's also economic nexus to consider. Even if an online retailer has no physical presence in New York, they still need to collect sales tax if they exceed certain sales thresholds. Currently, that threshold is $500,000 in sales and 100 transactions annually within New York State. Many major online retailers easily surpass these numbers, which means they're collecting New York sales tax regardless of where they're actually located.

Here's where it gets interesting for your wallet. If you buy jewelry from an online retailer who doesn't have nexus in New York, they won't charge you sales tax. But before you get too excited, know that you're still legally responsible for paying use tax directly to New York State. This is essentially the same amount you would have paid in sales tax, and you're supposed to report it on your annual tax return.

At Zalori, we believe in complete transparency about costs, including taxes. Whether you're shopping with us online or visiting one of our locations, you'll always know exactly what you're paying and why.

Tax on Custom Jewelry Creation and Repairs

Creating custom pieces and repairing beloved jewelry brings its own set of tax considerations. Understanding these rules helps you budget properly for these special services.

When you commission a custom jewelry piece, you're essentially purchasing newly created tangible personal property. New York treats this as a fully taxable transaction. The entire cost - including our craftsman's labor, the precious metals, genuine stones, and design work - gets taxed at the full rate for wherever the transaction takes place. This makes sense when you think about it: you're walking away with a brand new piece of jewelry, even though it was made specifically for you.

Our approach to handmade silver jewelry exemplifies this principle. Whether we're crafting a custom silver necklace or a bespoke gold ring, the entire creation process results in new tangible personal property that's subject to sales tax.

Jewelry repairs follow similar logic but can be slightly more nuanced. Most repairs involve adding new materials or significantly altering the original piece, which makes them taxable. When we replace a lost diamond, resize a ring with additional metal, or add a new clasp, we're transferring new tangible personal property to you. The labor and materials for these services are subject to the full sales tax rate.

Even repairs that seem purely service-based often involve some material component. Polishing might require compounds, cleaning might involve solutions, and most repairs need at least some new materials. In practice, nearly all jewelry repair work ends up being taxable in New York.

The underlying principle is straightforward: if the service results in you receiving new tangible personal property or significantly improves an existing item, it's taxable. This ensures consistency whether you're buying a finished piece or having one created or restored for you.

Frequently Asked Questions about NY Jewelry Sales Tax

When it comes to new york sales tax jewelry purchases, we hear the same questions over and over. Let's tackle the big ones that keep coming up, so you can shop with confidence and avoid any surprises at checkout.

What is the exact sales tax on a $5,000 diamond ring in NYC?

Here's where that hefty NYC tax rate really shows itself. When you're buying a $5,000 diamond ring in New York City, you'll pay the full 8.875% combined rate - no exceptions, no breaks.

The math is pretty straightforward: multiply $5,000 by 0.08875, and you get $443.75 in sales tax. Your total walks out the door at $5,443.75. That's nearly $450 extra just in taxes - enough to upgrade to a nicer setting or add matching earrings to your purchase.

This is exactly why understanding these costs upfront matters so much. When you're making a significant investment in something as meaningful as a diamond ring, every dollar counts. If you're thinking about diamonds from an investment angle too, our guide on Buying Diamonds as an Investment: What You Need to Know can help you see the bigger financial picture.

If I buy jewelry online from a store without a NY presence, do I pay sales tax?

This one trips up a lot of people, and honestly, it's a bit sneaky how it works. If you buy from an online retailer who doesn't have sales tax nexus in New York - meaning they don't have stores, warehouses, or enough sales activity here - they won't charge you sales tax at checkout.

But here's the catch: you're still on the hook for the tax. New York has something called use tax, which is basically sales tax that you pay directly to the state instead of through the retailer. The rate is exactly the same as what you'd pay if you bought the jewelry locally.

Most people report this on their annual state tax return, though let's be honest - many folks forget or don't realize they're supposed to. The state can audit these purchases though, and if they find unpaid use tax, you'll owe the original amount plus penalties and interest. Not exactly a fun surprise.

Are shipping and handling charges for jewelry taxable in New York?

Unfortunately, yes - New York considers shipping and handling charges part of the total sale price when the item itself is taxable. So when you're buying new york sales tax jewelry online, that sales tax gets calculated on your jewelry price plus whatever you're paying for shipping and handling.

Let's say you buy a $1,000 necklace with $25 shipping to your NYC address. You'll pay sales tax on the full $1,025, not just the $1,000 necklace price. It might seem like a small detail, but it adds up - especially on higher-value pieces where shipping costs can be more substantial.

The logic behind this rule is that the shipping is necessary to get your taxable jewelry to you, so it's considered part of the overall purchase. It's just one more reason to factor in all costs when you're budgeting for that special piece.

Conclusion: Navigating Your Next Jewelry Purchase

As you prepare for your next jewelry purchase, understanding new york sales tax jewelry rules will help you shop with confidence. There's something empowering about knowing exactly what to expect when you fall in love with that perfect piece.

The reality is that New York has some of the highest sales tax rates in the country, especially in New York City where you'll pay 8.875% on your jewelry purchase. But here's the thing - when you understand these costs upfront, you can budget properly and focus on what really matters: finding a piece that speaks to your heart.

Remember the key points that will guide your purchasing decisions. Jewelry is always taxable in New York, no matter the price - there's no magical threshold like with clothing. Whether you're buying online or in-store, sales tax will likely apply if the retailer has a presence in New York. And if they don't collect it, you're still responsible for use tax.

Custom pieces and repairs add another layer to consider. These services are generally taxable, including both materials and labor. Even shipping charges get taxed when you're purchasing jewelry online. It might seem like a lot to remember, but once you know the rules, they become second nature.

At Zalori, we believe that transparency builds trust. When you're investing in luxury jewelry crafted from precious metals and genuine stones, you deserve to know all the costs involved. Our commitment to exceptional craftsmanship extends to ensuring you have all the information you need to make confident decisions.

Tax compliance doesn't have to be complicated. By understanding these rules, you're protecting yourself from unexpected costs and ensuring your purchase experience is as smooth as the finish on our handcrafted pieces. Whether you're choosing a diamond engagement ring or treating yourself to a stunning gold necklace, informed purchasing leads to greater satisfaction.

Explore our handcrafted jewelry collections knowing that every piece represents not just beauty and quality, but also the confidence that comes from making a well-informed investment in luxury.