The Taxing Truth: Everything You Need to Know About Engagement Ring Costs

Beyond the Sparkle: Understanding the Full Cost of Your Investment

The tax on engagement ring purchases is an often-overlooked but crucial part of your budget. While you're focused on the perfect ring, tax implications should be part of your planning.

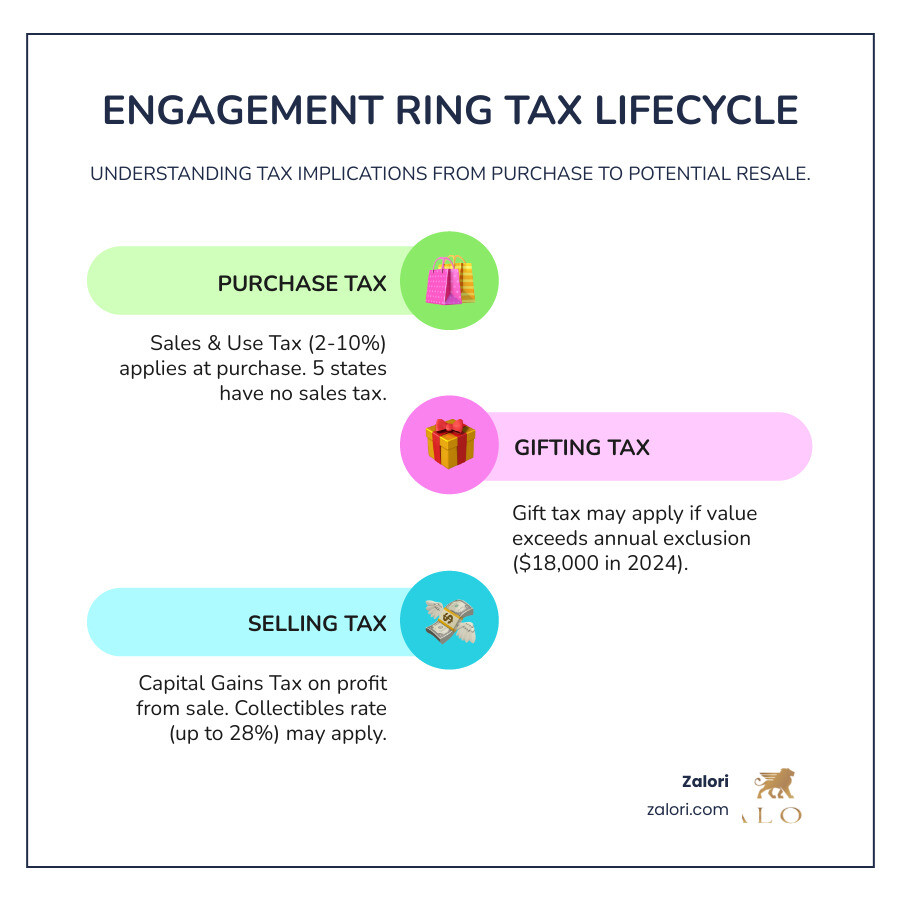

Quick Answer: What You Need to Know About Engagement Ring Taxes

- Sales Tax: Most states charge 2-10% sales tax at purchase (except Oregon, Alaska, Delaware, New Hampshire, and Montana)

- Gift Tax: May apply if the ring exceeds $18,000 in value (2024 limit)

- Not Tax-Deductible: Engagement rings are personal expenses and cannot be written off on your income taxes

- Use Tax: May apply for online purchases from out-of-state retailers

- Capital Gains Tax: May apply if you later sell the ring for a profit

The price tag isn't the final cost. Sales tax can add hundreds or thousands to your purchase. Rings valued over $18,000 may trigger gift tax reporting, and online or overseas purchases can incur use tax or customs duties. For example, industry data shows gift taxes on a $200,000 ring could result in $58,000 in tax obligations.

Understanding these tax implications helps you budget accurately and avoid surprises. Knowing which taxes apply protects your investment and peace of mind, wherever you buy.

I'm Eric Roach Zalori. Through my work with firms like Morgan Stanley and now leading Summit Metals Holdings, I've gained deep expertise in precious metals and luxury goods. I've seen how the tax on engagement ring purchases can surprise buyers. At Zalori, my focus is ensuring clients understand the true investment they're making—including all associated costs—when selecting fine jewelry crafted from genuine materials.

The First Tax Hit: Sales and Use Tax on Your Purchase

When shopping for an engagement ring, the final price is more than what's on the tag. Sales tax, added at the register, can increase the cost by hundreds or thousands of dollars depending on your location.

This is the first tax on engagement ring purchases that often surprises buyers. Let's break it down.

What are the tax implications of buying an engagement ring?

The primary tax you'll face when buying an engagement ring is sales tax. It's a consumption tax charged by state and local governments that gets added to your purchase price at checkout.

For example, an 8% sales tax on a $10,000 ring adds $800, making the total $10,800. This can be a shock if you haven't budgeted for it.

Sales tax rates vary dramatically by location. Knowing your local rate before you buy helps prevent surprises at the register.

Does sales tax vary by state?

Yes, and the differences can be substantial. Most states charge sales tax on jewelry, with rates ranging from 2% to over 10% when including local taxes.

Five states have no statewide sales tax: Oregon, Alaska, Delaware, New Hampshire, and Montana. This offers a significant advantage, though some local taxes may still apply.

Our Zalori locations are in states with sales tax, including Salt Lake City UT, New York City NY, Los Angeles CA, Dallas TX, San Diego CA, Chicago IL, and Maui HI. Each has a unique tax structure. For instance, California's 7.25% base rate is often pushed higher by local taxes. New York's system is also complex; learn more in our guide: Your Guide to Jewelry Sales Tax in New York City and State.

Some jurisdictions have tiered tax rates, charging more on higher-value purchases. Understanding jewelry sales tax by state helps you plan accordingly.

How are taxes handled for online and overseas purchases?

Buying an engagement ring online introduces different tax rules. Online retailers must collect sales tax if they have a physical presence, or "nexus," in your state.

If an online seller doesn't collect sales tax, you likely owe use tax to your state. This is a tax on out-of-state purchases where no sales tax was paid. You must self-report and pay it with your state tax return. It's a legal obligation, and states are increasing enforcement. Learn more about What is use tax?.

Buying from overseas adds more complexity. You'll likely face customs duties (tariffs on imports) and Value-Added Tax (VAT). These can add 20% or more to the price, not including currency exchange fluctuations.

We believe in transparency. In our online luxury jewelry collection, all applicable costs are clear from the start.

Are there tax-saving strategies when buying?

While you can't eliminate the tax on engagement ring purchases, a few legitimate strategies can help you save:

Buying in a no-tax state is the simplest strategy. Purchasing in Oregon, Delaware, New Hampshire, Montana, or Alaska can lead to big savings. However, be aware that your home state's use tax laws may still apply.

Tax-free holidays are offered in some states, but they rarely apply to luxury items like engagement rings. It's still worth checking your state's rules.

Shipping to an exempt address, like to family in a no-tax state, is a risky strategy. It can create insurance issues, and you're still legally obligated to pay use tax in your home state. It's wiser to pay the applicable tax or consult a tax professional.

Understanding these taxes helps you budget accurately. The sparkle is worth it when you're prepared for the full investment.

The Big Question: Is an Engagement Ring Tax Deductible?

After paying sales tax, many wonder if they can recoup some of the cost through tax deductions. It's a common question for such a large purchase. The short answer is no; the tax on engagement ring purchases doesn't usually lead to a deduction.

Why can't I write off my engagement ring on my taxes?

An engagement ring is not tax-deductible because the IRS classifies it as a personal expense. It's treated like any other item for personal use, such as groceries or clothing, not for business or generating income.

The IRS only allows deductions for specific expenses like business costs or certain investments. An engagement ring doesn't qualify. As H&R Block explains, it's a personal expense and cannot be written off on your income taxes.

While a significant personal investment, the IRS views an engagement ring like a vacation or furniture—a wonderful purchase, but not one that lowers your tax bill.

Can an engagement ring ever be tax-deductible?

While you can't deduct the purchase, there is one notable exception: you can get a tax deduction for making a charitable donation of the ring.

If circumstances change, you can donate the ring to a qualified 501(c)(3) charity. You may then be able to deduct the ring's fair market value. The charity must use the ring for its mission or sell it to fund its work.

There are requirements. For items over $500, you must file Form 8283. For items over $5,000, the IRS requires a qualified appraisal to determine its fair market value, which is not necessarily the purchase price.

To deduct the full fair market value, you must have owned the ring for more than one year; otherwise, the deduction may be limited to your cost. All charitable deductions are also subject to AGI limits (a percentage of your Adjusted Gross Income).

Keep meticulous records, including the appraisal and a written acknowledgment from the charity for contributions of $250 or more. While not a deduction at purchase, this offers a potential future tax benefit if circumstances change.

The Giver's Guide: Navigating Gift Tax and the Tax on an Engagement Ring

Giving a high-value engagement ring can trigger the federal gift tax. This surprises many, but it's an important consideration.

What are the gift tax implications of giving an engagement ring?

In the U.S., gifts exceeding the annual exclusion value may be subject to federal gift tax. For 2024, the annual exclusion is $18,000 per person, per year. Gifts below this amount do not need to be reported to the IRS.

An engagement ring can easily exceed the $18,000 limit. If it does, the giver must report it to the IRS by filing Form 709, the U.S. Gift Tax Return.

Until you are legally married, your fiancé(e) is not considered a spouse for tax purposes. Therefore, the unlimited marital deduction, which allows tax-free gifts between spouses, does not apply to the engagement ring. Standard gift tax rules apply.

Filing Form 709 doesn't automatically mean you owe tax. The reported amount is deducted from your lifetime gift tax exemption ($13.61 million in 2024). You only pay gift tax once you exceed this lifetime limit. However, reporting is mandatory for gifts over the annual exclusion. For more details, see the IRS gift tax FAQs.

For a very valuable ring, the tax can be substantial. For example, a $200,000 ring could trigger up to $58,000 in federal gift taxes, due in the year the gift is made. This highlights why understanding the tax on engagement ring is crucial.

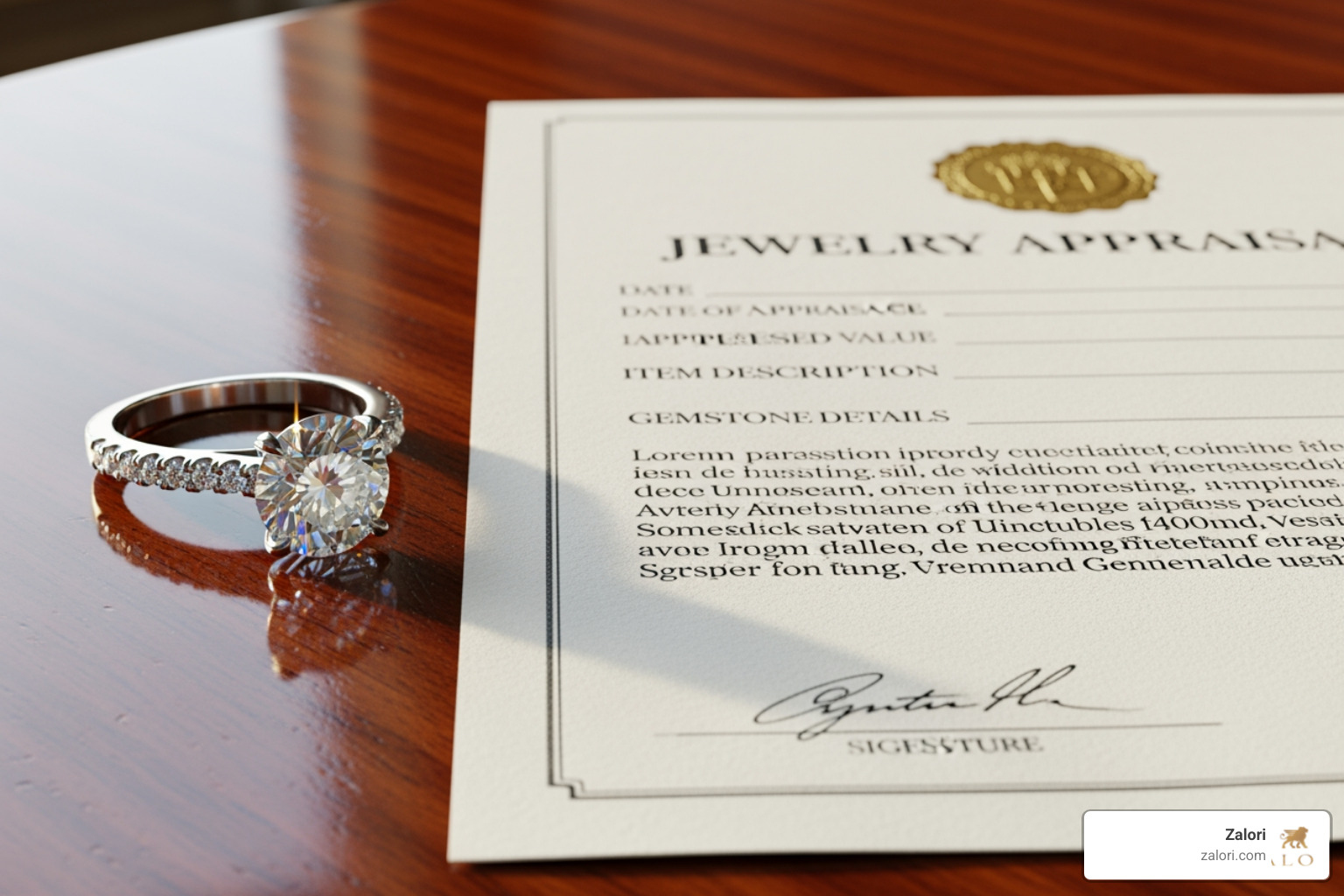

How is the value of a ring determined for the tax on an engagement ring?

For gift tax, the ring's value is its Fair Market Value (FMV) at the time of the gift, not its purchase price. FMV is the price a willing buyer and seller would agree upon, with neither being under compulsion to act.

To determine the FMV of a significant engagement ring, a professional appraisal is necessary. A certified appraiser examines the ring's characteristics (carat, cut, color, clarity, metal, craftsmanship) and current market conditions. This appraisal is crucial for both gift tax reporting and for insuring the ring for its true replacement value.

At Zalori, we understand the importance of precise valuation for tax compliance and peace of mind. To learn more about protecting your jewelry, read our guide: Learn how to insure your fine jewelry.

Are there ways to avoid gift tax on a very expensive ring?

For a high-value engagement ring that exceeds the annual exclusion, one strategy to manage gift tax is to structure it as a "conditional gift" or a "loan" until the wedding.

The logic is that the gift is not legally complete until the condition—the marriage—is met. Once married, the transfer occurs between spouses and qualifies for the unlimited marital deduction, making it exempt from gift tax.

This strategy requires careful planning and written documentation. The legal definition of a "conditional gift" can vary, so consulting a tax or legal professional is highly recommended to ensure compliance with IRS rules.

What about the tax on an engagement ring that is inherited?

Inheriting an engagement ring involves different tax considerations, primarily estate tax and capital gains tax if you later sell it.

The value of inherited jewelry is part of the deceased's estate. The federal estate tax exemption is very high ($13.61 million in 2024), so most inheritances are not subject to federal tax. However, some states have their own estate or inheritance taxes, so check your local laws. See the IRS estate tax info for details.

If you sell an inherited ring, capital gains tax applies. Fortunately, inherited property receives a "stepped-up basis." This means your cost basis for tax purposes is the ring's fair market value at the time of the original owner's death, not its original purchase price. For example, if a ring bought for $500 is worth $5,000 when inherited, your basis is $5,000. Selling it for $6,000 results in a taxable gain of only $1,000. This stepped-up basis can significantly reduce your capital gains tax liability.

After the Proposal: Tax Scenarios for Selling, Divorce, or a Broken Engagement

Life is unpredictable. Broken engagements, divorce, or other life changes can lead to the decision to sell an engagement ring. Each scenario has unique legal and tax implications.

Who keeps the ring if an engagement is broken?

Who keeps the ring after a broken engagement is a common legal question. Most states view an engagement ring as a "conditional gift," given on the condition of marriage. If the marriage does not occur, the ring should be returned to the giver.

However, state laws vary. Some states consider it an unconditional gift, while others may factor in who was at fault for the breakup. In states like New York, California, and Texas, the ring is generally considered a conditional gift that must be returned.

Though tradition suggests returning the ring, the law can be complex. You can learn more here: Who Keeps the Engagement Ring?. If the ring is returned, the gift is considered incomplete, and any gift tax reporting obligations are reversed.

How is an engagement ring treated in a divorce?

In a divorce, an engagement ring is treated differently. Courts typically classify it as a "pre-marital gift," meaning it was given before the marriage. Therefore, it is considered the recipient's separate property and is not subject to division as a marital asset.

The recipient usually keeps the ring without it being part of the divorce settlement. The marriage fulfilled the 'condition' of the gift, making it the recipient's separate property. This principle applies in many states, including California, New York, and Texas.

What are the tax implications of selling an engagement ring?

Selling an engagement ring for any reason can trigger capital gains tax. The IRS considers jewelry a "capital asset."

If you sell a capital asset for a profit, that profit is subject to capital gains tax. For collectibles like jewelry, the tax rate can be as high as 28%, which is higher than the rate for many other assets. The IRS provides more guidance here: IRS capital gains info.

Here’s a simple breakdown of how it works:

-

Determine Your Cost Basis: This is your starting point.

- Purchased: Your basis is the original cost, including sales tax.

- Gifted: Your basis is usually the giver's original cost basis.

- Inherited: Your basis is its fair market value at the time of inheritance (a "stepped-up basis").

- Calculate the Gain/Loss: Subtract your cost basis from the selling price. If the result is positive, it's a capital gain. If negative, it's a capital loss.

- Pay Tax: You owe tax on the gain. A capital loss can be used to offset other capital gains and sometimes a limited amount of regular income.

For example, if you sell a ring with a $10,000 basis for $12,000, you have a $2,000 taxable capital gain. If you sell it for $8,000, you have a $2,000 capital loss.

Understanding these implications is key if you view jewelry as an investment. While its emotional value is priceless, its monetary value fluctuates. Learn more in our article: Is your gold jewelry a smart investment?.

Frequently Asked Questions about Engagement Ring Taxes

It's normal to have tax questions about a purchase as significant as an engagement ring. Here are answers to some common ones.

Is an engagement ring purchase tax-deductible?

The short answer is no. An engagement ring is not tax-deductible. The IRS classifies it as a personal expense, made for personal enjoyment rather than for business or to generate income. Therefore, you cannot write off the cost on your income taxes.

The only exception is if you donate the ring to a qualified 501(c)(3) charity. In that case, its appraised value may be deductible as a charitable contribution, subject to IRS rules.

Do I have to pay gift tax when I give an engagement ring?

Gift tax is more about reporting than immediate payment for most people. As the giver, you have a reporting requirement if the ring's fair market value exceeds the annual gift tax exclusion, which is $18,000 for 2024.

If the ring's value is over $18,000, you must file Form 709. However, you likely won't pay tax immediately. The amount over the annual exclusion is simply deducted from your substantial lifetime gift tax exemption ($13.61 million in 2024). You only pay gift tax if you exceed this lifetime limit.

Your fiancé(e) is not considered a spouse for tax purposes until you are married. The unlimited marital deduction for spouses does not apply to a ring given before the wedding.

Do all states charge sales tax on engagement rings?

No, not all states charge sales tax on engagement rings. Five states have no statewide sales tax:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

However, be aware that some local jurisdictions in these states may still impose their own sales taxes.

Most other states charge sales tax on jewelry, including states with Zalori locations like New York, California, and Texas. Rates vary by state and locality, so check the exact rate for your purchase location to budget for the full tax on engagement ring and avoid surprises!

Conclusion: Making a Smart and Sparkling Investment

We've moved beyond the sparkle to uncover the financial landscape of buying an engagement ring. Understanding the "taxing truth" is part of making a smart purchase.

We've covered the key tax points: sales and use taxes add to the initial cost; an engagement ring is a personal expense and not tax-deductible (unless donated); high-value rings may trigger gift tax reporting; and selling a ring can have capital gains tax considerations.

At Zalori, we believe true luxury includes being fully informed. Our commitment to lasting value means helping you understand every aspect of your investment. By planning for sales tax, understanding gift tax, and knowing the ring is a personal, non-deductible purchase, you're making a smart and sparkling choice.

We're here to ensure your cherished piece brings joy, without financial headaches.